Will YOUR Organization survive the Aftermarket Mobility Transformation?

-

Strategic

Imperatives -

Growth

Gap -

The Yellow Brick

Road -

Transformational

Growth

Strategic Imperatives For Aftermarket Mobility

Adapting to the digitization of customer journeys across industries and sectors, leveraging innovative tools to fulfil evolving customer expectations.

Integrating disruptive technologies like artificial intelligence (AI) and wireless connectivity to accelerate innovation in diagnostics and serviceability.

Capitalizing on strategic partnerships with ecosystem players in fleet management, software, telematics, and shop management solutions to drive enhanced brand promotion.

How do you shift from where you are to what you want to become? How do you fill the gap?

Based on those strategic imperatives the gap between where you are now and where you need to be to achieve transformational growth is daunting.

Effective Growth Coaching increases productivity by over 53%

Over 40% of professionals would like to have more meaningful networks

84% of Executives say Innovation is critical but lack resources

The Three Components Required for Transformational Growth

Growth Opportunities for Aftermarket Mobility

Digital Retail of Parts Across Channels

The online sale of vehicle replacement parts and accessories is increasingly becoming a mainstream distribution channel in the B2B and B2C automotive aftermarket sector.

Uberization of Vehicle Services

The use of innovative web-based applications for on-demand booking of vehicle services is fast emerging as a promising opportunity, as customers seek increasing levels of convenience.

The Proliferation of Electric Vehicles

This is unlocking new prospects for replacement components, battery diagnostics services, and 4R services.

ADAS-equipped Vehicles

The emergence of advanced driver assistance systems (ADAS) increases the replacement and servicing need for sensors, radars, cameras, and sensor re-calibration services.

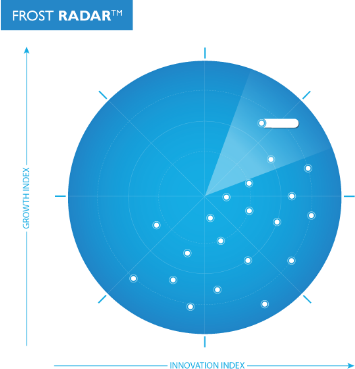

Frost RadarTM

Benchmarking Your Future Growth Potential

Our work is focused exclusively on identifying the growth opportunities of the future and evaluating companies that are best positioned to take advantage of them. The Frost Radar™ is a robust analytical tool that allows us to evaluate companies across two key indices: their focus on continuous innovation and their ability to translate their innovations into consistent growth.

To discover how you benchmark

against competition

A PRACTICAL, HIGH IMPACT, SCALABLE TRACKING SOLUTION

Measure with The Growth

& Innovation Index

-

2

Major Indices

-

10

Analytical Algorithms

-

1

Platform

Connect with the Brightest Minds in Growth Innovation Leadership

Our community activates your success with our peer-to-peer network, peer meetings, annual growth events, executive roundtables, and access to inspiring activities such as our innovation workshops.

Join our exclusive community of like-minded professionals today.

Join Growth CommunityGrowth Council Think Tank Series

Driving Forward: Aftersales Innovation in the Electric Vehicle Era

Seamless Support for Autonomy: New Aftersales Avenues for Autonomous Vehicles

E-commerce in New Vehicle Retail - A Disruptive Force or Temporary Fad?

How Will the Implementation of Right to Repair Revolutionize Mobility?

Closing the Loop: How to Embrace the Circular Economy in the Mobility Aftermarket

How Does Consolidated Fleet Demand Drive Innovations in the Aftermarket?

How Can Aftermarket Providers Capitalize on the Proliferation of Electrified Commercial Vehicles?

How Evolving Buying/ Ownership Models Transform Off-Highway Equipment Aftersales?

Seizing New Applications & Opportunities in Automotive Tools & Equipment Manufacturing

How Can Data Monetization Revamp Downstream Mobility Channels?

Electronics Boom in New Vehicles: Will Dealerships Outpace the Independent Aftermarket?

Heavy Duty Diagnostics: A Lucrative Opportunity or an Independent Aftermarket Pain-point?

Activate your transformational journey

Through growth coaching you will gain the tools necessary to develop powerful growth pipeline strategies that will fuel the future of your company.

Growth Coaches | Think Tanks | Growth Experts

Growth for Leaders & Companies

Maximized through collaboration

Continuous flow of Growth Opportunities

Proven Best Practices

Optimised Customer Experience

Implementation Excellence

Industry Leadership

"*" indicates required fields

Navigating the Evolving Landscape of the Automotive Aftermarket Sector

Quality, Safety, and Beyond: How OEMs are Enabling Growth in the Aftermarket Mobility Ecosystem

Navigating the Evolving Landscape of the Automotive Aftermarket Sector

The automotive aftermarket sector has witnessed a significant transformation driven by transformative megatrends and disruptive technologies in recent years, driven by the changing preferences and expectations of modern consumers. Today, consumers are more demanding than ever when it comes to after-sales operations. The availability of auto services and products at the right place and at the right time is key to securing customer loyalty and profitability. The automotive aftermarket, traditionally considered the secondary market, has now evolved into a customer experience-centric value proposition, leveraging innovative business models and digital technologies to unlock new business opportunities.

“Global Automotive Aftermarket expected to record 7.7% year on year growth, driven by the Chinese Aftermarket” – Frost and Sullivan (Global Automotive Aftermarket Outlook, 2023)

- How is your leadership team responding to the customer-centric shift in the automotive aftermarket driven by digital technologies?

- What steps is your organization taking to ensure the timely availability of auto services and products, and how does this impact customer loyalty and profitability?

Navigating Change and Collaboration in the Automotive Aftermarket

The Aftermarket sector stands at a crossroads where wise decisions and timely actions can either propel it forward or leave it in the dust. One of the key drivers of change in this landscape is the rise of electric vehicles (EVs). As EVs become more prevalent, the traditional parts and services offered by the aftermarket for internal combustion engine (ICE) vehicles will need to evolve in order to remain relevant in the changing automotive landscape. This necessitates a critical reassessment of the automotive aftermarket’s competitive strategy to ensure its continued relevance in the evolving automotive landscape.

- How is your organization adapting to the increasing prevalence of electric vehicles in the automotive aftermarket?

- What steps are you taking to reassess your competitive strategy for continued relevance in the evolving automotive landscape?

Original Equipment Manufacturers (OEMs), the primary manufacturers of vehicles, are also making aggressive moves to enter the aftermarket space. This shift has the potential to disrupt the traditional aftermarket players, but it can also lead to beneficial collaborations and partnerships. The rise of OEMs in the aftermarket reflects the growing importance of providing comprehensive services and products to consumers throughout the entire lifecycle of their vehicles opening up new growth opportunities for the industry.

- How is your organization adapting to the changing automotive industry, especially with the rise of electric vehicles in the aftermarket?

- How are you preparing for competition or collaboration with OEMs in the aftermarket, as they expand their offerings for the entire vehicle lifecycle?

One of the most significant factors affecting the automotive aftermarket is the in-depth penetration of digitalization. The advent of digital technologies has enabled aftermarket businesses to streamline their operations, enhance customer engagement, and create personalized experiences. With the help of data analytics and smart systems, companies can anticipate consumer needs and tailor their offerings accordingly.

In addition, digital platforms have made it easier for consumers to access information about auto products and services. They can read reviews, compare prices, and make informed decisions, making it imperative for aftermarket businesses to maintain a strong online presence. These platforms have also opened up new avenues for marketing and reaching a broader audience.

- How is your organization using digitalization to improve customer engagement in the automotive aftermarket?

- What steps are you taking to maintain a strong online presence and reach a broader audience in the aftermarket using digital platforms?

Adapting to the Future and Navigating Growth Gaps by Forging Partnerships

Growth gaps in the aftermarket sector are prevalent due to a combination of factors. Rapid technological advancements often outpace the sector’s ability to adopt and integrate new solutions, creating a technology lag. The Aftermarket sector’s vast data potential remains underutilized, with many businesses failing to harness analytics for predictive maintenance or inventory management effectively. Environmental concerns and sustainability expectations introduce another gap, as companies struggle to meet stringent regulations and provide eco-friendly solutions necessitating a focus on implementing and sharing best practices across the industry.

- How are your stakeholders bridging growth gaps in the aftermarket sector, especially in technology adoption, data utilization, and sustainability compliance?

Evolving consumer behaviour, characterized by demands for convenience, speed, and transparency, present additional challenges. Furthermore, fierce competition within the sector poses barriers to smaller players. Closing these growth gaps will necessitate a focus on forging strong partnerships. n a world increasingly focused on sustainability, strategic partnerships with eco-friendly entities offer a competitive edge by helping companies meet stringent environmental regulations. Moreover, strategically aligning with partners to meet evolving customer expectations for convenience, speed, and transparency positions businesses for sustainable growth.

- How is your organization forming partnerships to meet evolving customer expectations and sustainability requirements in a competitive aftermarket landscape?

CAN FROST & SULLIVAN BE YOUR PARTNER OF CHOICE FOR GROWTH?

Frost & Sullivan has six decades of experience analysing industry transformation and identifying innovative growth opportunities. Allow us to guide you through your transformation journey by working collaboratively with the ecosystem community of companies in your industry. Our transformation journey is fuelled by four powerful components, ensuring your success in navigating the ever-changing landscape of your industry.

- Schedule a Growth Dialog with our team to dive deeper into transformational strategies and explore specific needs within your company.

- Become a Frost Growth Expert in your area of specialization and share your expertise and passion with the community through our think tanks.

- Join Frost & Sullivan’s Growth Council and gain access to think tanks focused on the transformational growth strategies of the aftermarket industry.

- Designate your company as a Company to Action to increase exposure to investors, new M&A opportunities, and other growth prospects for your business.

Quality, Safety, and Beyond: How OEMs are Enabling Growth in the Aftermarket Mobility Ecosystem

Original equipment manufacturers (OEMs) are playing a pivotal role in shaping the dynamic landscape of the evolving aftermarket mobility domain. They are persistently establishing fundamental benchmarks for quality and safety, wielding a profound influence across the entire ecosystem. Despite encountering formidable competition from independent parts manufacturers, trailblazing OEMs are influencing not just the accessibility and quality of spare parts but also steering the course of technological advancements, sustainability endeavors, and customer interactions. They are progressively adopting an ecosystem-centric strategy, engaging in collaborations with diverse stakeholders to foster inventive solutions such as data-driven maintenance and connected repair platforms.

Here in this story, we examine how OEMs are actively fostering an environment that nurtures the development of the global aftermarket ecosystem.

How is your team collaborating with ecosystem players to foster growth in the global aftermarket industry?

Fuelling Technological Advancements and Innovation:

OEMs are consistently expanding the horizons of technological innovation within the automotive ecosystem to enhance vehicle performance, safety, and efficiency. Their progress extends to the aftermarket industry, where they strive to provide consumers with cutting-edge components. Take the example of Gulf countries, which are witnessing a spurt of independent aftermarket players integrating state-of-the-art equipment and offering cost-effective solutions to authorized service centres.

Is your team analyzing how OEMs are innovating across regions to align with automotive ecosystem megatrends?

Steering Sustainability Initiatives:

In an era characterized by increasing emphasis on environmental awareness, OEMs are spearheading sustainability initiatives with an aim to decrease the carbon footprint of the aftermarket industry. These automakers are working aggressively towards managing the environmental impact of auto-parts disposal, and vehicle reuse. They are also implementing innovative best practices across vehicle remanufacturing, recycling, and end-of-life activities.

Hyundai & Kia Sustainability Developments and Partnership Ecosystem

- Hyundai & Kia, as a part of the Supplier CO2 Emission Monitoring System, plan to use blockchain technology and artificial intelligence (AI) to monitor carbon emissions at every supply chain stage, collecting carbon emissions data in the process.

- The company works with tier I suppliers in establishing supplier Environmental, Social, and Governance (ESG) risk management assessments and setting preventive goals to avoid risks along the supply chain.

- It evaluates suppliers based on quality, technology, supply stability, and sustainability by conducting audits and providing environmental management system certification and training programs to

tier I suppliers globally.

To know more, click here.

Driving Quality Assurance and Standardization:

One of the primary impacts of OEMs to the aftermarket mobility industry is establishing of stringent quality standards. As manufacturers of original vehicles, automakers are setting the benchmark for performance, quality, safety, and reliability to name a few. This commitment to quality ensures that aftermarket parts and services meet the same rigorous standards, assuring consumers of compatibility and dependability.

Standardization on the other hand is crucial for maintaining the reliability of vehicles. This not only profits consumers by ensuring the longevity and performance of their vehicles but also nurtures a competitive aftermarket ecosystem where various providers stick to common standards, facilitating interchangeability and ease of access for consumers throughout the value chain. For example, the implementation of the Bharat Stage Emission Standards 6 (BS-VI) in India, resulted in many OEMs deciding not to sell diesel vehicles, impacting diesel powertrain part sales.

In Focus – India

- While multi-brand service chains pose significant competition to the original equipment suppliers (OES) channel in vehicle servicing due to their robust quality brand image, their impact is constrained by limited presence.

- The absence of quality standards and regulations in the aftermarket is prompting an increase in local manufacturing and the import of inferior parts.

- Substandard parts and cheap imports from China are causing an adverse impact on the sales of quality parts especially in the northern and eastern parts of India.

To know more, click here.

Is your leadership team implementing best practices in the aftermarket space to drive growth?

About Frost & Sullivan

Frost & Sullivan, the growth pipeline company, enables clients to accelerate growth and achieve best-in-class industry positioning in terms of innovation and leadership. The company’s ‘Growth Pipeline-as-a-Service’ provides corporate management teams with transformational strategies and best-practice models that catalyze growth opportunity generation, evaluation, and implementation. Let us coach you on your transformational journey, while we actively support you in fostering collaborative initiatives within the global aftermarket ecosystem. This journey is fueled by four powerful components, ensuring your success in navigating dynamic business and industry landscapes.

- Schedule a Growth Dialog with our team to dive deeper into transformational strategies and explore specific needs within your company.

- Become a Frost Growth Expert in your area of specialization and share your expertise and passion with the community through our think tanks.

- Join Frost & Sullivan’s Growth Council and become an integral member of a dynamic community focused on identifying growth opportunities and addressing critical challenges that influence industries.

- Designate your company as a Companies to Action to maximize your exposure to investors, new M&A opportunities, and other growth prospects.