Will YOUR Organization survive the Power & Energy Transformation?

-

Strategic

Imperatives -

Growth

Gap -

The Yellow Brick

Road -

Transformational

Growth

Strategic Imperatives for Power & Energy

Evaluating new solutions, business models, and value propositions to ensure security and meet the increasing demand for power amid the building pressure to decarbonise power generation.

Leveraging digital transformation and technology innovation to revolutionize businesses and differentiate solution portfolios to remain competitive.

Delivering affordable power technologies at scale while navigating global supply chain complexity and regional regulatory mandates.

How do you shift from where you are to what you want to become? How do you fill the gap?

Based on those strategic imperatives the gap between where you are now and where you need to be to achieve transformational growth is daunting.

Effective Growth Coaching increases productivity by over 53%

Over 40% of professionals would like to have more meaningful networks

84% of Executives say Innovation is critical but lack resources

The Three Components Required for Transformational Growth

Growth Opportunities for Power & Energy

Strengthen Cloud Computing Capabilities to Streamline Digital Transformation:

- Effective deployment of new products and services

- Optimize and manage distributed energy resources across the grid

- Enable effective data-sharing between key stakeholders in energy transition

Growth of Innovative Business Models:

- 24/7 clean energy on demand

- Energy-as-a-service

- Guaranteed performance-as-a-service

Growth of the Hydrogen Economy:

- Hydrogen supply to commercial and industrial customers

- Hydrogen infrastructure investment opportunities

- Driving hydrogen production cost savings through innovation

- Digital solutions to optimise hydrogen infrastructure and trading

Electrification of Industries:

- Commercialization of lower TRL technologies

- As-as-a-service business models

- Outcome based emissions management

Frost RadarTM

Benchmarking Your Future Growth Potential

Our work is focused exclusively on identifying the growth opportunities of the future and evaluating companies that are best positioned to take advantage of them. The Frost Radar™ is a robust analytical tool that allows us to evaluate companies across two key indices: their focus on continuous innovation and their ability to translate their innovations into consistent growth.

To discover how you benchmark

against competition

A PRACTICAL, HIGH IMPACT, SCALABLE TRACKING SOLUTION

Measure with The Growth

& Innovation Index

-

2

Major Indices

-

10

Analytical Algorithms

-

1

Platform

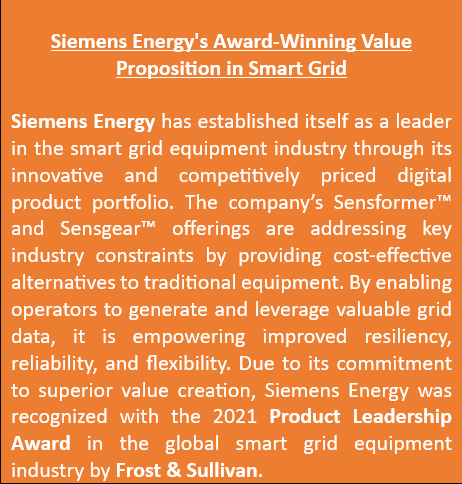

Recognizing Excellence and Leadership in Power & Energy for 20 years

Our best practices analysis provides in-depth examination of successful strategies and tactics used by leading companies across all industries, and offers recommendations for implementation to drive performance and success

2022 Global Data Centre Infrastructure and Operations Customer Value Leadership Award

Read MoreExperience

Analysts

Connect with the Brightest Minds in Growth Innovation Leadership

Our community activates your success with our peer-to-peer network, peer meetings, annual growth events, executive roundtables, and access to inspiring activities such as our innovation workshops.

Join our exclusive community of like-minded professionals today.

Join Growth CommunityGrowth Council Think Tank Series

How will the sector evolve in 2023: Challenges & Opportunities

Is Hydrogen changing the dynamics of the global energy industry?

Understanding the impact of the Inflation Reduction Act on Power & Energy

Opportunities for hard-to-abate industries to reduce their emission footprint

Sustainability Strategies for data centers - getting ready for a net-zero future

How could technology define the future of nuclear power?

How could Metaverse disrupt the Energy industry?

Strategies to retain talent by leveraging Artificial Intelligence

How can companies minimize wastage by utilizing next-generation technology?

What are some key investment opportunities in Power Generation?

How will the sector evolve in 2024: Challenges & Opportunities

Activate your transformational journey

Through growth coaching you will gain the tools necessary to develop powerful growth pipeline strategies that will fuel the future of your company.

Growth Coaches | Think Tanks | Growth Experts

Growth for Leaders & Companies

Maximized through collaboration

Continuous flow of Growth Opportunities

Proven Best Practices

Optimised Customer Experience

Implementation Excellence

Industry Leadership

"*" indicates required fields

Are you navigating the complexities of regional power industry dynamics?

Power Grid Transformation: Building a Brighter Future with Renewables

Are you navigating the complexities of regional power industry dynamics?

Frost & Sullivan’s Energy webinar series delved into the topic, ‘Key Regional Power Industry Dynamics Driving Global Investment.’ Led by industry experts, the session highlighted on the latest investment megatrends impacting key regional power industries, including generation, grids, energy storage, and deep energy decarbonization.

The panel included Jonathan Robinson, Growth Expert and VP of Research at Frost & Sullivan; Lucrecia Gomez, Growth Expert and Research Director at Frost & Sullivan; Milagros Andurell, Growth Expert and Research Analyst at Frost & Sullivan; and Neha Tatikota, Growth Expert and Industry Analyst at Frost & Sullivan. Each speaker brought their unique perspectives on what to expect in energy for 2024.

Note: Gain valuable perspectives from these industry experts by clicking here to access the recorded session of the webinar.

- Energy Industry Reforms: Latin American nations are looking at expediting regulatory processes for battery energy storage, while addressing regulatory gaps to foster growth. In Europe, initiatives like Fit for 55 and REPowerEU are prioritizing security of supply and renewable energy targets.

What industry and regulatory best practices is your company adopting to drive energy transition?

- Continued Reliance on Coal: Despite aspirations for renewable energy, Southeast Asia’s heavy dependence on coal persists due to entrenched interests and economic needs, making a rapid transition challenging.

How is your organization leveraging strategic initiatives to tackle challenges and achieve sustainability goals?

- Rising Demand for Gas: With declining domestic gas production, Southeast Asian nations are shifting from being exporters to importers, creating trade opportunities and increasing reliance on liquefied natural gas(LNG) to meet growing energy demands.

Is your company leveraging strategic partnerships with key geographies to gain a competitive edge in the industry?

- Renewable Energy Growth and Implementation: While there’s significant growth potential for renewables in Asia Pacific, especially in solar and wind, actual implementation is facing hurdles such as slow construction rates and regulatory complexities.

How is your organization leveraging growth opportunities in the renewable energy space?

- Investments in Transmission Grid: Prioritizing simultaneous transmission grid development alongside capacity expansion is essential to avoid undermining investments in renewable energy initiatives.

Is your board devising the right investment strategies to capitalize on the shifting dynamics in the energy landscape?

“Investments in transmission grids must align with the rapid development of solar and offshore wind projects, a crucial imperative as we advance into 2024. Regulatory hurdles loom large, necessitating federal intervention for streamlined regulations to drive progress effectively. Without this alignment, even substantial investments risk failing to catalyze the necessary infrastructure development in the year ahead.”

– Lucrecia Gomez

Growth Expert, Frost & Sullivan

Amidst the dynamic realm of power and energy, geographic initiatives are laying the groundwork for embracing innovative solutions. Join us in sharing your thoughts and experience on how global megatrends such as grids, energy storage, and deep energy decarbonization are impacting investments. Let’s explore how these developments are driving progress, fortifying resilience, and ushering in a new era of industry best practices, poised to reshape the energy landscape for a sustainable future in 2024 and beyond.

Power Grid Transformation: Building a Brighter Future with Renewables

The power and energy industry is undergoing a significant transformation, driven by the growing need for grid modernization to accommodate the increasing adoption of renewable energy sources like solar and wind power. Leading companies are tackling this head-on by investing heavily in grid modernization projects. Despite challenges in the supply chain and economic uncertainty, investments in 2023 reached new heights, highlighting the industry’s commitment to a more sustainable and resilient future.

Is your organization equipped with the expertise to navigate the challenges of a successful grid modernization transformation?

What’s Driving the Renewable Energy Revolution?

Record investments in solar and wind power are highlighting a global shift away from fossil fuels, with a staggering $567 billion being poured into renewables in 2023 alone. Despite facing supply chain hurdles and economic uncertainty, the industry is responding by significantly increasing spending on grid modernization, which is currently reaching $174.42 billion in 2023. This transformation is demanding not only adaptable grids that can handle the variability of renewable sources, but also investments in disruptive technologies like Distributed Energy Resource Management Systems (DERMS) and Virtual Power Plants (VPPs) to optimize energy flow. Government support through policies and ambitious renewable energy targets continues to accelerate this critical shift towards a sustainable energy future.

As grid modernization demands evolve, what best practices is your company implementing to prioritize effective project planning and risk management?

Challenges Threatening Power Grid Modernization

The seemingly straightforward goal of modernizing power grids is facing a growth barrier fueled by a confluence of economic and operational hurdles. Fluctuating raw material costs, particularly copper, are straining manufacturers and supply chains. High capital expenditure (CapEx) continues to be a challenge, especially for utilities in developing industries struggling with financial constraints. Additionally, slow decision-making within the utility sector, exacerbated by the evolving energy landscape, is delaying grid modernization projects. Bureaucracy and the evolving energy landscape with disruptive technologies like rooftop solar and electric vehicles (EVs) are creating delays in approvals for grid upgrades. Industry leaders are actively seeking solutions to bridge this gap, such as exploring alternative materials and advocating for streamlined permitting processes, to ensure a robust grid for the future.

With transformative megatrends reshaping the energy landscape, what strategies is your company implementing to overcome challenges in grid modernization?

A Robust Growth Pipeline for Grid Equipment

Government incentives for clean energy (100GW wind, 350GW solar PV in 2023) are necessitating grid

What strategic partnerships is your organization exploring to unlock the full potential of emerging growth opportunities?

Grid modernization not only presents a complex challenge, but also a vast opportunity for the power and energy industry. Business leaders are required to act decisively to capitalize on the growth prospects fueled by clean energy initiatives, electrification efforts, and rising global demand. Embracing innovation in materials and advocating for streamlined permitting processes are crucial. By proactively addressing these challenges and seizing the growth opportunities, business leaders can shape a more resilient and sustainable future for the power grid.

JOIN US, AND TOGETHER, LET US EMBARK ON THIS TRANSFORMATIONAL JOURNEY!

In this dynamic industry, seizing growth opportunities and addressing challenges systematically will be key to staying ahead of the curve. Our transformation journey is fueled by four powerful components ensuring your success in navigating the ever-changing landscape of the Power and Energy industry:

- Schedule a Growth Dialog with our team to dive deeper into transformational strategies and explore specific needs within your company.

- Become a Frost Growth Expert in your area of specialization and share your expertise and passion with the community through our think tanks.

- Join Frost & Sullivan’s Growth Council and gain access to think tanks focused on the transformational growth strategies of the Environment and Sustainability industry.

- Designate your company as Companies to Action to increase exposure to investors, new M&A opportunities, and other growth prospects for your business.