Indonesia has set an ambitious target of achieving 99.7% electrification by 2025 in its recently unveiled Electricity Supply Business Plan for 2016-2025, Rencana Umum Penyediaan Tenaga Listrik (RUPTL). This would require 80.5 GW of new power plants to be constructed by 2025. While fossil fuels such as coal and gas will still account for more than 79% of the fuel mix, renewables such as geothermal, min-hydro and solar PV are expected to increase their share to nearly 20%.

While the economic development in West and more recently in China was powered through large fossil plants, emerging countries such as Indonesia have the opportunity to leapfrog using new energy technologies such as microgrids, and not overtly rely on risky investments in centralized power generation projects.

Indonesia’s 17,508 islands (of which slightly more than 900 are permanently inhabited) not only present a huge challenge, but also a unique opportunity for energy planners. Indonesian power grid has eight interconnected power networks spanning across populated regions such as Java, Madura, Bali, and Sumatra and 600 isolated grids operated by PLN. The network is besieged by generation capacity addition delays and severe transmission bottlenecks, thus leading to power outages.

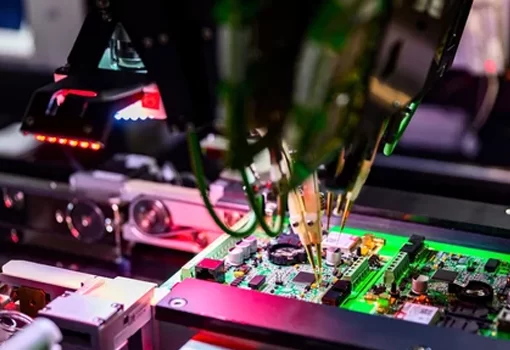

Microgrid, which is a self-sufficient localized grouping of electricity load and generation source, can help to provide stable power supply both in islanded and grid connected situations. PLN is looking at converting many of the islands using only diesel generators to include solar photo voltaic and thus making it a hybrid source. Microgrid can integrate a variety of locally available clean energy sources such as solar, micro hydro, biomass, biogas, wind, and so on. It can also provide stability of supply when combined with battery storage and advanced automation & controls for demand-supply balancing. Microgrid is increasingly becoming affordable due to reduction of its component costs and also when one accounts for the economic losses because of poor quality power supply.

Indonesia has several microgrid installations such as those in Nusa Penida, Baron Techno Park, Morotai Island, Pulau Panjang, Pulau Balang Lompo, Pulau Tankake, and Pulau Kelang with solar PV, wind, and diesel hybrids. However, for the country to reach its goal of 99.7% electrification, such installations should increase multi-fold within the next decade.

The following are some of the critical success factors and enablers for microgrids in Indonesia:

Decentralization of Decision Making: The local PLN Regional Unit office & local government administrative office should be involved in the decision making of power generation for the said administrative region, with focus on energy security and independence.

Localization: One of the key objectives of regional power supply plans should include local skills development and utilization of locally available resources for building and operating such facilities.

Foreign Investment: Projects less than 10 MW should be opened to foreign equity investments. Participation of local government body and regional PLN as a shareholder would ensure their involvement and commitment of the region toward successful and timely project execution.

Standardized Packages: System vendors and design & integration companies should develop several standardized microgrid packages rather than customize those for every single project. This will help in significant cost reduction for both hardware and services.

Modular Approach: Microgrid projects can start small to address a particular community’s needs or specific loads and then be scaled up as more funding is available or the project becomes self-sustaining.

Industrial Microgrids: Providing incentives for industries and mining facilities to develop captive renewable microgrid systems using their own sources of funding will ease the pressure on PLN’s grid and thus help cater to other customers.

Tourism Resorts: Tourist resorts and high end developments are low hanging fruits for microgrid developments because of relative affordability to invest and also obtain better value through green branding.

New Business Models: The Indonesian Government, regulator, and PLN should create conducive business climate for private investors to explore new business models such as microgrid as a service. In this model, developers will build microgrids and sell electricity directly to a single large or numerous small customers.

Indonesia’s estimated potential for renewable energy includes more than 1,000 MW of micro/mini hydro, 32,654 MW of biomass apart from significant quantum of solar PV and wind power, all of which are spread across the archipelago. This creates the perfect resource condition for microgrid market development. The rapidly growing demand for electricity cannot be satisfied only by PLN or a few large IPPs. With innovative approaches to technology, financing, equipment sourcing, construction, and revenue models, Indonesia can secure its energy future using microgrids. Such projects can also become a catalyst for job creation in far flung locations.