While reams of newsprint have been devoted to the companies that have been derailed by COVID, there has been scant attention paid to those that have gone bold with mergers & acquisitions (M&A) to drive growth. Several companies, most notably in the security industry, have seized the opportunity to acquire innovative, financially stable businesses and create a pipeline for solid growth in the post-COVID era.

Interestingly, such consolidation activity has not been limited to larger firms. Smaller companies are collaborating as well to compete with their more established counterparts. The pandemic has created opportunities in the security space for companies with positive or surplus cash flows to expand into alternate applications, enhance existing market share and/or penetrate new markets. While the spotlight has been on acquisitions like Motorola’s purchase of PELCO and IndigoVision, there have been other significant, but less publicized, M&As that are changing the balance of the security industry’s value chain.

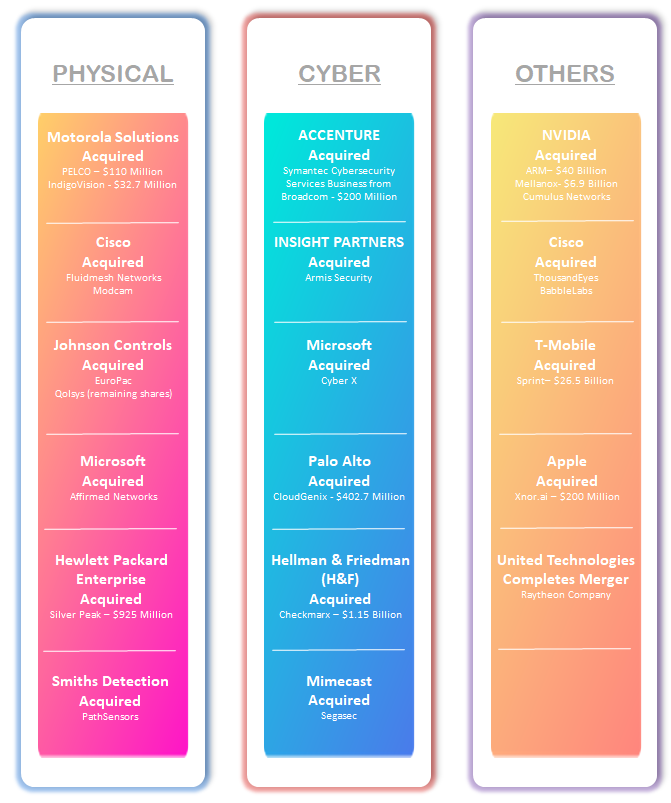

Mergers & Acquisitions in the Security Industry during the COVID-19 Pandemic, 2020

Frost & Sullivan’s observations of M&A activity in the security industry provide insights into how leading security industry participants hope to strategically position themselves in the COVID era and beyond.

Motorola Solutions: Expanding its value proposition across the integrated security landscape

PELCO, an independent company with a 2,000-strong workforce, was acquired by Schneider Electric in a mega-deal worth $1.54 billion in 2007. However, the acquisition proved unsuccessful with Schneider selling PELCO to Transform Capital Group, a US-based private equity firm, in March 2019 for an undisclosed amount. In August 2020, Motorola Solutions, a leading global provider of mission-critical communications, snapped up PELCO at a bargain price of just $110 million.

This came on the heels of Motorola Solutions’ acquisition of a UK-based IP video surveillance company, IndigoVision, for $37.2 million in March 2020. These recent acquisitions build on earlier purchases—Avigilon in 2018 for $1 billion, Watch Guard in 2019, VaaS International Holdings in 2019 for $445 million, and Avtec in 2019—to position Motorola Solutions as a strong contender in the security and surveillance segment. Its expanded value proposition now includes a range of HD cameras, advanced video analytics, network video management hardware and software, and access control solutions.

Cisco: Network infrastructure behemoth on a buying spree

In April 2020, Cisco acquired Fluidmesh Networks, a leader in wireless backhaul solutions for on-the-move critical assets and applications, e.g., Wi-Fi in trains. The acquisition allows Cisco to vertically integrate IoT networks with larger networks.

In May 2020, Cisco took over its longstanding business partner, ThousandEyes, an internet monitoring and intelligence company that measures the performance of internet connections across the globe. ThousandEyes, AppDynamics, and Cisco SD-WAN can change the overall dynamics of digital delivery of applications and services on cloud-to-cloud and internet-to-cloud. They can provide connectivity to businesses through SD-WAN, monitor the quality of connections through ThousandEyes, and measure the performance of applications running on the connections through the advanced analytics of AppDynamics.

Also in May 2020, Cisco acquired Sweden-based Modcam, a video analytics company that uses artificial intelligence (AI), machine learning (ML), and computer vision technologies to track people over large spaces and provide real-time actionable insights. This takeover complements the Cisco Meraki portfolio of cross-camera tracking while allowing it to offer revolutionary insights into the retail industry.

More recently, in August 2020, Cisco acquired BabbleLabs, which uses advanced AI algorithms to distinguish human speech from any unwanted noise, resulting in enhanced speech quality in communications and conferencing applications. With this acquisition, Cisco is set to bring noise removal capabilities to its Webex Meetings users, wherever they are and however they connect.

Johnson Controls: Adds companies to reinforce its security capabilities

Johnson Controls acquired Netherlands-based EuroPAC Alarmcentrale and EuroPAC Telefooncentrale in July 2020. The acquisitions will strengthen Johnson Controls’ video as a service (VaaS) capabilities by augmenting its offerings to include monitoring, tracking, and third-party call center services.

After owning a majority stake since 2014 in Qolsys, a smart building solution provider with more than 4,000 dealers and service providers worldwide, Johnson Controls finally acquired the remaining stake in August 2020. The acquisition complements Johnson Controls’ global intrusion products business.

NVIDIA: Redefined offerings from this security industry outsider directly affect mobile/cloud computing, an essential requirement for current security solutions

In the biggest chip deal ever concluded, NVIDIA bought British chip designer ARM for a whopping $40 billion in September 2020. This positions NVIDIA firmly in the cloud data center market, making it a $300 billion company—almost double the size of Intel Corp.

This follows a busy year for NVIDIA, which completed its acquisition of Mellanox, an end-to-end high-speed Ethernet and interconnect solution provider, for $6.9 billion in April 2020. The move highlights NVIDIA and Mellanox as prominent players in high-performance computing. Collectively, NVIDIA’s computing platform and Mellanox’s interconnectivity capabilities power more than 250 of the world’s top 500 supercomputers. NVIDIA’s customers include leading cloud service providers and computer manufacturers.

In May 2020, NVIDIA announced it would acquire Cumulus Networks, which provides Linux-based OpenStack for network switches and tools to manage open networking platforms. The vertical integration of NVIDIA, Mellanox and Cumulus will accelerate software-defined data center deployment while providing greater value to customers from stack to chips and software to analytics.

M&A transforms the security ecosystem

The security ecosystem has seen a flurry of M&A deals this year. Smiths Detection, a strong player in CBRNe detection systems, acquired US-based PathSensors, a biotech and environment testing company with a wide range of detection capabilities in biothreats and food/plant/human pathogens, including anthrax, ricin, Ebola, salmonella, phytophthora, ralstonia, and SARS-CoV-2. This acquisition strengthens Smiths Detection’s detection capabilities across the biological spectrum and allows it to expand into new markets like food and agricultural safety.

Other important M&As in 2020 have included Accenture’s acquisition of Symantec’s cybersecurity services business from Broadcom; T-Mobile’s $26.5 billion acquisition of Sprint to create a third wireless carrier competitor after Verizon and AT&T; and the $1.1 billion acquisition of Israeli cybersecurity company Armis Security by private equity firm Insight Partners.

Apple acquired US-based Xnor.ai, which develops AI and ML. In addition to acquiring CyberX to complement its IoT security and monitoring platform, Microsoft also announced the acquisition of US-based Affirmed Networks, which provides virtualization and cloud-based mobile network technology. Meanwhile, Hewlett Packard Enterprise (HPE) completed its acquisition of SD-WAN leader Silver Peak for $925 million. With this, Silver Peak will become part of Aruba Networks—another HPE company—and complement its portfolio of edge to cloud networking from all aspects, including wired, wireless, LAN, and WAN.

In continuing action, Palo Alto’s acquisition of Cloudgenix for $402.7 million boosts the shift from SD-WAN to Palo Alto’s SASE platform, allowing enterprises to use any available WAN network to connect their offices and branches securely. Private equity firm Hellman & Friedman shelled out a hefty $1.15 billion for Israeli company Checkmarx, whose platform enables several Fortune 1000 clients to secure their source code and embed various security features during the software development life cycle (SDLC).

United Technologies Corporation (UTC) completed its merger with Raytheon to create an aerospace and defense conglomerate named Raytheon Technologies Corporation. Two business units of UTC—Pratt & Whitney and Collins Aerospace—will be combined with two units of Raytheon—Intelligence, Space and Airborne Systems and Integrated Defense & Missile Systems.

Mimecast’s acquisition of Segsec, an Israel-based cybersecurity company that provides phishing, digital impersonation, and spoofing protection solutions, helps it widen its offerings beyond email security to provide an integrated solution for email and web security services to prevent the threats that are around the perimeter. The solutions will cover email and data security and monitor domain registrations, new certificates, mail server provisioning, social networks, and other online resources.

Priorities and Consequences: The evolving industry structure

A cursory analysis of overall M&A trends suggests that technology has been the driving force behind most of the deals, except where the motivation has been inorganic market and customer base expansion, as with T-Mobile’s acquisition of Sprint.

However, our observations show that the true attraction is vertical integration. We recognize that such M&A allows the acquiring company to enhance its capabilities significantly and stay agile, resilient and relevant amidst technological disruptions. Global security giants with deep pockets—Honeywell, Cisco, Johnson Controls, Motorola Solutions, etc.—have been the biggest beneficiaries, periodically acquiring innovative start-ups and potentially high-growth companies.

Customers or consumers of these services also stand to gain from accessing optimized and seamlessly integrated solutions from a single OEM rather than managing multiple OEMs and systems in their deployments.

M&A is rife across the cybersecurity domain. Recent Frost & Sullivan research estimates that the global cybersecurity market was about $150 billion in 2019 and will remain the fastest-growing segment over the next decade.

Surveillance and communication networks, which are critical to the security industry, are also technology segments where we have witnessed consolidation activity. Frost & Sullivan projects the global surveillance market to grow from $40.8 billion in 2019 to $55 billion in 2030, while the global communication network market is set to expand from $28.3 billion to $36 billion over the same period.

Frost & Sullivan Perspective: More consolidation driven by efficiency and growth

The increasing complexity of technology and business operations will fuel further M&A activity, potentially allowing top-tier players to capture higher market share.

The convergence of cybersecurity, IoT, AI and data analytics with physical security has been accompanied by the emergence of many non-conventional players expanding the security industry’s overall scope. In this era of digital transformation, traditional system integrators will need to evolve to provide security solutions that enable the seamless integration of IT and OT networks. These are capabilities that, in many cases, are not part of the organic construct of market leaders, so M&A is necessary. A failure to enhance these capabilities—either organically or inorganically—might create a new roster of post-COVID winners in the security industry.